It is often difficult to tell the quality of a decision from the outcome, sometimes a well-thought-out decision may fail, and poor decisions may prevail. While it might seem counterintuitive, in addition to perseverance and brilliant business ideas, luck and randomness play a huge role in the ultimate success of a startup. The outbreak of the Coronavirus is a good reminder that the world of business is full of risks that are outside of any individual’s control. While the environment of late is full of uncertainty, The Mills Fabrica webinar series aims to support the startup community by offering strategic advice and practical tips to weather the storm.

History is one of our greatest aids in business as in life. While the real level of severity of the Coronavirus is unclear at this point, by referencing to all pandemic outbreaks in the last 3 decades, The Mills Fabrica determined the most critical factor to consider is whether a pandemic comes along with an underlying structural economic problem. As the Coronavirus is hitting at the start of a recession, compounding its effect on the economy & financial market, a slower recovery by historic standard should be expected. To weather the storm, startups should prioritise financial prudence for the next 12 months by securing income stream and implementing cost-cutting measures.

Impact on China/ HK’s Investment Activity: Economic climate more important than pandemics alone

From an investment standpoint, the structural economic climate at the time of a pandemic outbreak is believed to be the key influencing factor of the financial impact, as opposed to the severity of the pandemic. On a standalone basis, the financial impact of pandemic outbreaks is often short-lived. In most cases, the financial market typically rebound within 6-12 months after the initial outbreak and the shortfall is often characterised by a lack of liquidity in the financial market temporarily. In the case of SARS where the outbreak has caused significant disruption in the Hong Kong & Chinese financial market, it showed a limited impact on the APAC & US market in terms of valuation and deal volume. However, over the period of a structural economic downturn demonstrated by the Global Financial Crisis, investment activities were significantly dampened in all measurements globally.

Coronavirus standalone is unlikely to create a long-term impact on the financial market. However, as the outbreak occurred at the start of a recession, the impact will likely to mimic the characteristic of a structural economic challenge. In a recessionary environment where continued weak business spending and investment is expected, startups should prepare for a challenging fundraising environment ahead. The key is therefore for financial prudence to allow sufficient runway before fundraising again when the climate has improved.

Impact on HK’s Retail Market: Compounded impact may mean prolonged recovery period

Similar to the financial market, while the average recovery period of the retail market ranges across 6-12 months, the underlying economic environment at the time determines the speed of recovery. Prior to the outbreak, Hong Kong has entered its first recession for a decade due to social movements in 2019. Furthermore, current coronavirus resulted in domestic shoppers staying at home and international travels being disrupted by cancelled flights for an extended period. This compounded impact of recession from movements and the current health situation will significantly affect Hong Kong’s retail be it in traffic decline, store closures and rethinking of retail dynamics. In terms of the path to recovery, Hong Kong’s rapid recovery post-SARS was driven by rebound of Mainland Tourism spurred by government policies like “Individual visiting scheme”. In the current situation, the absence of potential government policy levers and dampened social sentiment from earlier social movements will make it more challenging to generate the momentum needed to span the same level of recovery. Startups with businesses focused on retail would need to take into account the prolonged recovery expected and consider mitigation measures such as optimising existing retail businesses, going digital or exploring alternative markets.

Survival tips for startups

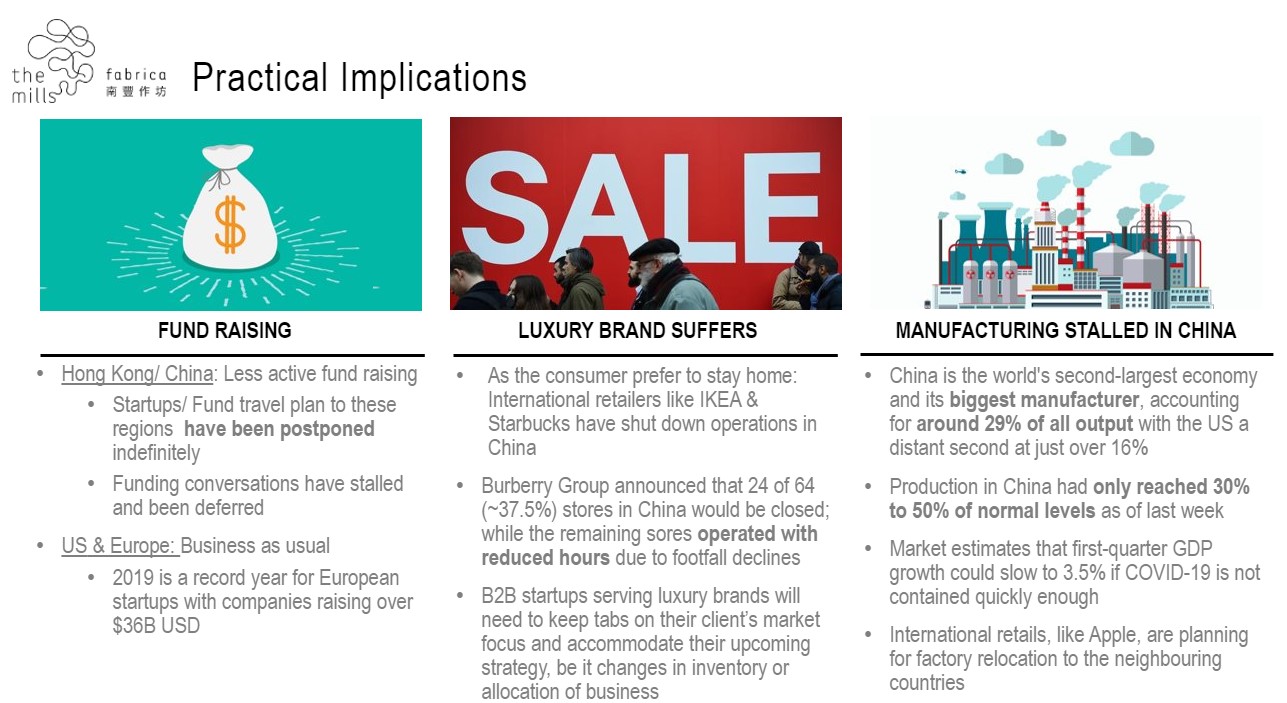

Going forward, we foresee 3 immediate practical implications for startups and businesses under current climate. The first revolves around potential challenges in fund raising and hence the need for prudency in cashflow management. The second centers on luxury and other retail sectors spill-over impact to other areas such as those B2B startups that serve such clientele. The third involves potential delays in manufacturing and production due to temporary factory closures in Mainland China. Some considerations are as follows:

To weather the storm ahead, 3 potential directional areas for companies to consider include:

1) Financial planning on cash flow, 2) Implement cost-cutting measures and, 3) Focus on business optimisation.

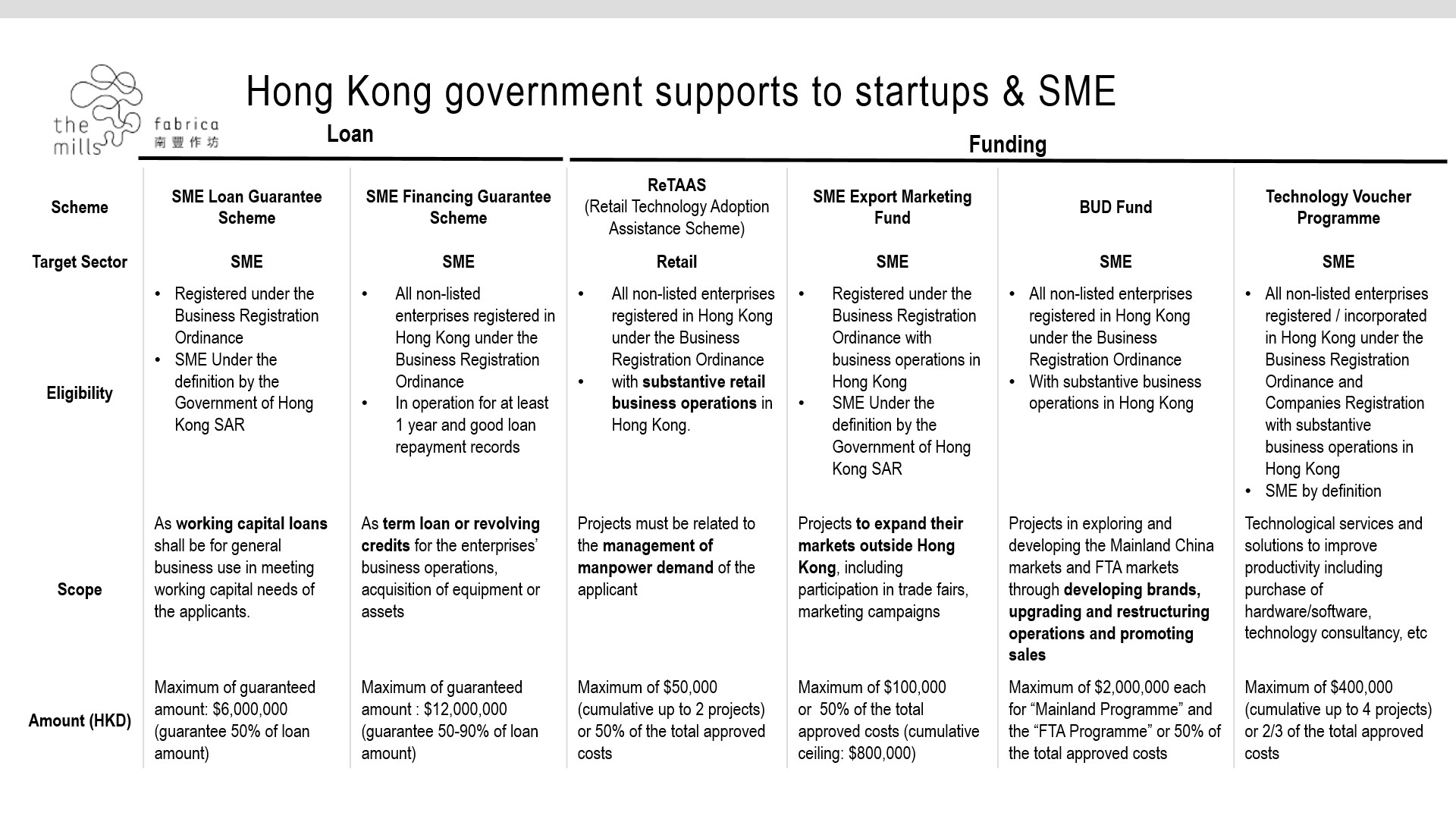

As fundraising is expected to be challenging for coming 8-12 months, startups are advised to apply for loans and maintain healthy working capital; we have put together a list of potential government loans available for Hong Kong companies as follows:

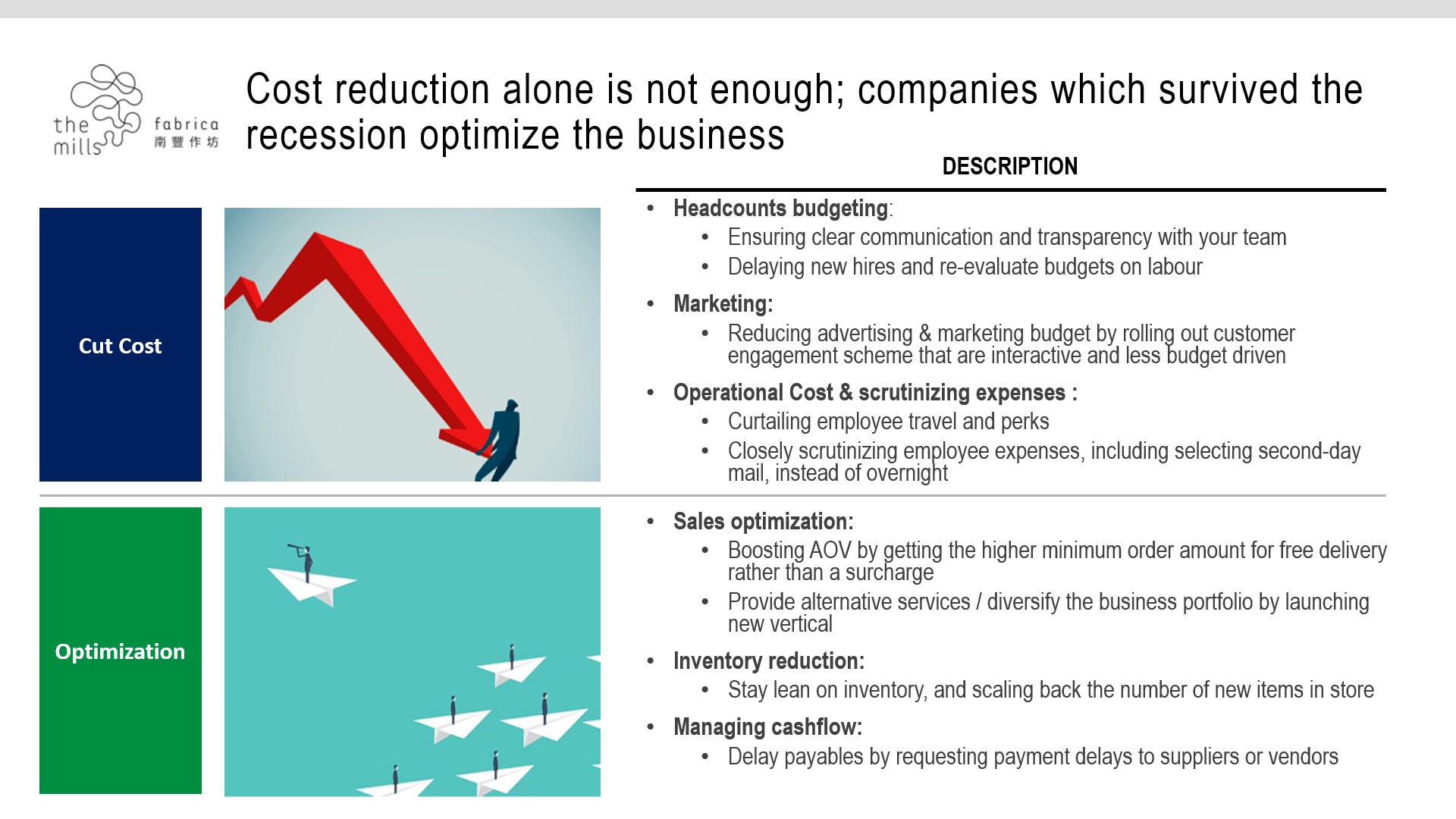

Aside from considering external financing options, companies that weather the storm during recession or crisis often undertake internal measures of adjustment. The following chart illustrates directional measures that past companies have considered:

Overall measures can be divided into cost reduction and operations optimization. Difficult times require prudence in cash outflow, a good exercise is to examine your business along various operational buckets including headcount, marketing and general administrative matters to identify potential adjustments. In terms of revenue and other operations, the goal is to identify ways to increase cash in interim be it in new sales opportunities or inventory/ payables management. Most importantly, tough times call for resilience, dedicating time to communicating to teams and maintaining staff morale is equally if not more significant than other measures.

Weathering the Storm

Undergoing an economic downturn and recovery are a natural part of any business. Weathering the storm might be challenging, but the ability to withstand and thrive is also the mark of what builds enduring companies overtime. Challenging times lie ahead, but we look forward to weathering this storm with our startup community and partners together.

Disclaimer

This webinar conducted in zoom and the information, statements, analysis, views, opinions and conclusions contained in this Webinar PowerPoint deck and any related materials have been prepared, compiled or provided by “The Mills Fabrica” (which expression covers those corporate entities include The Mills Limited, Fabrica Incubator Limited, The Mills (BVI) Limited and their subsidiaries, affiliates or partners) as a service to its members/site visitors/readers. They are not intended to constitute advice of any kind or the rendering of legal, consulting or other professional services.

All content found on this Webinar PowerPoint deck and related materials including figures, tables, charts, texts, images, audio, recording or other formats were created for information purposes only. They are meant to provide insights, and are general in nature, and the opinions or recommendations expressed in the Webinar PowerPoint deck are those of the authors only and may not necessarily represent the views of The Mills Fabrica.

All rights reserved. No part of any statement made in the course of this Webinar presentation PowerPoint deck may be used, reproduced, distributed or transmitted in any form or by any means, including photocopying, recording or other electronic or mechanical methods without the prior written consent of The Mills Fabrica.

Although The Mills Fabrica believes that all these information, both written and oral, given in the course of or in connections with the Webinar presentation PopwerPoint deck are correct and up to date, no warranty or representation or accuracy or suitability or reliability as to such presentation is given and no responsibility or liability is accepted by The Mills Fabrica or by any of its agents, directors, employees or by any person giving presentations or providing materials in respect of any loss, claims, costs or expenses, including indirect or consequential damages or lost profit, arising in any way from or in connection with errors or omissions in any information provided. The Mills Fabrica reserves the right to amend the information and the presentation at any time without notice.

The Webinar PowerPoint deck may include links to other resources and websites. These links are provided for convenience only and The Mills Fabrica does not endorse, approve or make any representation or claim regarding their accuracy, copyright, compliance or legality. Nor does it warrant the performance, effectiveness or applicability of any listed sites or links in the Webinar PowerPoint deck.

By acceding to this service or accessing this zoom webinar, you acknowledge and agree that The Mills Fabrica disclaims any and all liability to you or any person for any direct, indirect, implied, punitive, special, incidental or other consequential damages arising directly or indirectly from any access to or participation in or use of the information contained in the Webinar PowerPoint deck.

Registration for a Webinar only constitutes an agreement to attend or participate, but not a contract for consultancy or advice. Registration does not establish any contractual relationship with The Mills Fabrica.

Source

Materials used in the article are sourced from Bloomberg, HK Gov, IMAA, NASDAQ, SCMP