- ABOUT US

- INVESTMENT FUND

- PARTNERSHIP SERVICES

- IMPACT INITIATIVES

-

SPACES

- HONG KONG

- Co-working space

- Event Space

- Prototyping Lab

- LONDON

- Co-working space

- Event Space

-

FABRICA X

- HONG KONG

- Campaign

- Events

- Online Store

- LONDON

- Exhibition

- Retail

- Subscribe

The Mills Fabrica's 2023 Impact Report

Celebrating our 5th anniversary, The Mills Fabrica stands committed to fostering, accelerating, and supporting techstyle and agrifood innovators, creating an innovation platform that catalyzes planet-positive change.

Download the full 2023 Impact Report

Our impact at a glance

In our first five years,

In our first five years,

20+

startups invested

8

funds invested

360+

Fabrica Happenings took part

650+

submissions received in our international student competitions

100+

Innovative and sustainable brands collaborated with Fabrica X

45,000+

individuals and startups took place in Fabrica Happenings

012023 Impact Report

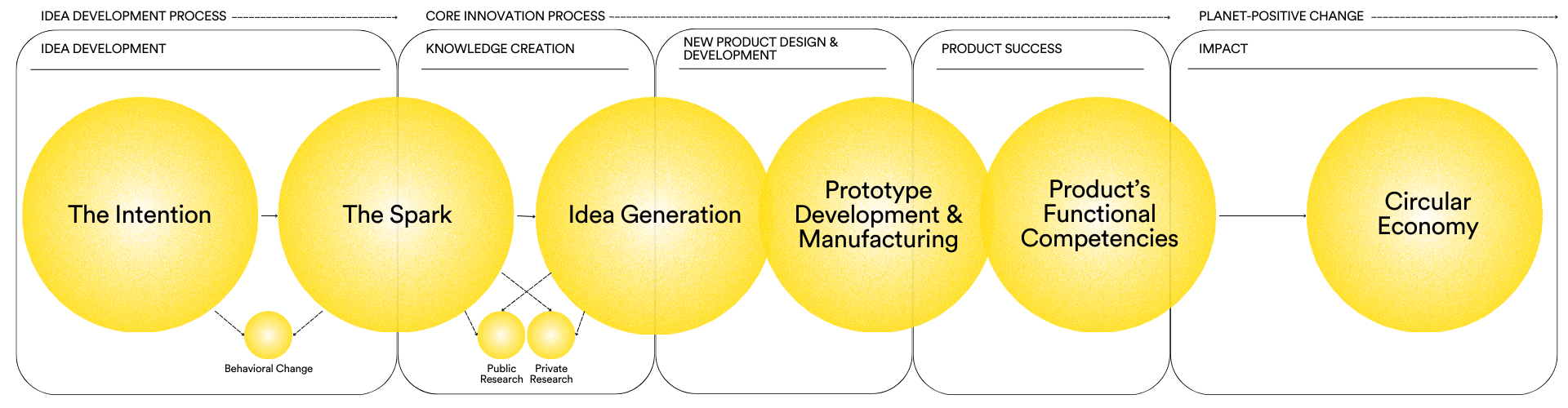

The Mills Fabrica’s Innovation Framework

The Mills Fabrica has established an innovation framework to support and accelerate innovations within the techstyle and agrifood industries. This framework comprises three phases: Idea-Development Process, Core-Innovation Process, and Making and Measuring Planet-Positive Change. Each phase is designed to support stakeholders at different stages of the innovation development process.

Over the last five years, we have tailored our business streams to cater to each phase, maximizing the chances of realizing impactful innovations. By fostering knowledge transfer, entrepreneurship, and partnerships, The Mills Fabrica aims to create a dynamic ecosystem that propels the techstyle and agrifood industries toward sustainability.

022023 Impact Report

Fabrica

Investment Fund

Investment Fund

Download our Impact Report 2023

The Fabrica Investment Fund plays a crucial role in the later stages of our innovation framework by providing capital to high-potential startups, enabling them to scale their solutions and achieve significant environmental and social impact. We have invested in over 20 pioneering startups and 8 funds.

The fund aligns investment decisions with the planetary boundaries framework and focuses on upstream innovations that can fundamentally transform these industries. Notable portfolio startups include:

- Circ: Pioneering recycling technology for polycotton-blend textiles, collaborating with brands like Zara and Mara Hoffman.

- Colorifix: Utilizing DNA sequencing to create sustainable color pigments, reducing the environmental impact of textile dyeing.

- Mango Materials: Converting methane gas into biodegradable biopolymers, addressing plastic pollution and greenhouse gas emissions.

- unspun: Developing 3D weaving technology for on-demand garment production, minimizing overproduction and fabric waste.

- Michroma: Innovating natural food colorants from fungi, offering safer and sustainable alternatives to synthetic dyes.

- The Supplant Company: Transforming agricultural side-streams into ingredients that address food insecurity and climate change.

Our investment in diverse, strategically aligned funds enables us to back a range of innovations, from precision agriculture and crop protection to animal health, alternative proteins, innovative materials, and bio-based dyes in the textile and apparel, and agrifood sectors.

AgFunder invests in innovative AgTech and food-tech startups to address critical challenges like food security and environmental impact. Fall Line Capital provides early-stage deep tech companies with strategic investment and guidance to grow into impactful AgTech and foodtech players. The Good Fashion Fund (GFF), through its “Five Goods” framework, drives sustainable textile manufacturing in India and Bangladesh by providing long-term loans and environmental and social support.

032023 Impact Report

Incubation Program

Encompassing access to co-working spaces, expert sessions, workshops, and showcasing opportunities through our Impact Retail concept Fabrica X, the incubation program offers tailored support to startups at the later stages of the innovation process. The Mills Fabrica has incubated 15 innovators from the techstyle and agrifood industries, including Provenance, Modern Synthesis, Ixon, and unspun. By providing bespoke resources, mentorship, and networking opportunities, we help these startups refine their innovations and scale their impact.

Conversations with co-founders Felix Cheung of Ixon and Jen Keane of Modern Synthesis highlight the program's support in their ventures through the complexities of scaling innovative businesses.

Download our Impact Report 2023

042023 Impact Report

Fabrica Partnerships and Happenings

Spanning the entire innovation framework, Partnerships and Fabrica Happenings encourage collaboration and knowledge sharing.

Partnerships with The Earthshot Prize and the H&M Foundation via the Global Change Award, alongside our Innovation Scouting and Integration Program, allow us to support a broader range of innovators while helping brands integrate innovation into their business models.

Fabrica Happenings connects innovators with industry stakeholders, fostering a collaborative ecosystem that accelerates the development of sustainable solutions and raises awareness of socioenvironmental issues. Since its inception, The Mills Fabrica has hosted over 360 events such as London Craft Week, Future Fabrics Expo, and Denim Futures Conference, engaging more than 45,000 individuals.

Download our Impact Report 2023

052023 Impact Report

International Student Competitions

Our international student competitions are designed to identify and nurture the next generation of innovators, providing them with the resources and support needed to bring their ideas to life.

Competitions, such as the Central Saint Martins x The Mills Fabrica Prize (CSMxTMF Prize) and Techstyle For Social Good (TFSG), have received over 680 submissions from 41 countries and awarded HKD1.9 million in prizes.

The report highlights winners like The Moonbeam Co., which upcycles brewer’s spent grains (BSG) into granola, addressing waste management and promoting sustainable food production.

Download our Impact Report 2023

062023 Impact Report

Fabrica X – Impact Retail Concept

Located in Hong Kong and London, Fabrica X is our consumer-facing platform that responds to the later phases of the innovation framework. This impact retail concept educates the public on the latest innovations solving the industry's most pressing socioenvironmental issues and inspires them to adopt a more conscious lifestyle.

Our platform also provides a venue to showcase and sell sustainable products, offering much-needed exposure to young sustainable brands and highlighting the latest innovative ideas.

Thematic campaigns like Biomaterials and Denim Futures educated consumers on the environmental impacts of materials and consumer behaviors, emphasizing the crucial role of conscious consumption in driving sustainability.

The concept has showcased 100+ innovators and sustainable brands, attracting over 80,000 visitors.

Download our Impact Report 2023

072023 Impact Report

Fabrica Lab

Fabrica Lab, our prototyping facility, supports earlier stages of the innovation framework by offering a space to experiment and develop new ideas. By providing access to advanced tools and a collaborative community, Fabrica Lab helps innovators test and refine their concepts, turning their ideas into impactful solutions, and driving forward the creation of sustainable technologies.

The lab also offers experiential workshops and has created the Future-Maker Award to recognize Hong Kong-based fashion students who embed sustainable design principles. The report includes insights from Meisze Tsang, founder of TMS.SITE, on her journey with Fabrica Lab.

Download our Impact Report 2023